Unlike some competitors that require you to pay extra for a time-tracking module, all FreshBooks plans come with unlimited time tracking. You can start a timer from within the mobile app to log hours spent on a particular project or sync data from tools like Asana and Trello. Our staff of experienced, professional AR specialists are trained to manage your receivables while treating your customers with patience and respect.

Your Rights When Dealing with Source Receivables Management, LLC

Striven has designed accounting solutions tailored to a dozen industries. Its retail solution, for example, includes CRM, inventory management and marketing features to integrate with its accounting platform. But its nonprofit solution includes tools for managing records and scheduling events and even includes a donation portal.

Personal loan and debt relief reviews

Our partners cannot pay us to guarantee favorable reviews of their products or services. Do you keep getting calls from an unknown number, only to realize that it’s a debt collector on the other line? If you’ve been called by any of the following numbers, chances are you have collectors coming after you, and we’ll tell you how to stop them. We give a factual review of the following debt consolidation, debt settlement, and loan organizations and companies to help you make an informed decision before you take on a debt. Since Source Receivables Management handles debts for a range of companies, validating your debt can help you identify the reason you’ve been contacted.

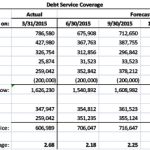

What Are Accounts Receivable?

I decided to try again to confirm and I keep being told verbally and by chat that it would be deleted but I think they are saying that to get me off the phone. Transunion and Experian are still looking into it but Equifax came back saying the debt was verified within 24 hours….can they really verify it that quick? Do you know if there is contact to the EO for Sprint I mean I want some type of written confirmation if not I want to show the EO that their employees are giving incorrect information. Don’t have time to go to your local courthouse to check the status of your case? We’ve created a guide on how to check the status of your case in every state, complete with online search tools and court directories.

What is accounts receivable? How to manage in 2024

95+ years of combined experience covering small business and personal finance. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. Copyright ©2001-document.write(new Date().getFullYear()) Fair Isaac Corporation. I am about to pay them over the phone, they are telling me that they PFD.

Here are our guides on how to stop wage garnishment in all 50 states. Some creditors, banks, and lenders have an internal collections department. If they come after you for a debt, Solosuit can still help you respond and resolve the debt.

Therefore, it is important that you manage your accounts receivable carefully. Source Receivables Management is a legitimate debt collection agency that’s licensed to operate in all 50 states since 1999. While they are https://www.business-accounting.net/degree-of-financial-leverage-dfl/ not a scam, they have had their share of negative reviews, customer complaints, and lawsuits in the past. When you sell on credit, you will undoubtedly need to keep track of the amounts owed to you by your customers.

We provide a seamless experience for your customers, many of whom never realize we exist as a separate company. Though we’re an important part of your team, we exist in the background, ensuring that your AR runs smoothly so you can focus on managing your business. Basically Sprint verbally agreed that if I pad them directly they would recall the collection https://www.online-accounting.net/ and it would be removed from my credit report. Well I paid and waited a month AND…..The collection updated the collection as PAID which caused my score to drop since it changed the status date. I contacted Sprint and again they verbally agreed that it would be removed but when I contacted the collection agency they are saying that is not true.

- Accounts receivable balances that will not be collected in cash should be reclassified to bad debt expense.

- Add accounting widgets to your phone’s home screen; track time using your Apple Watch.

- Source Receivables Management collects debts for a diverse range of businesses.

- Xero is another reliable product when it comes to standard accounting capabilities.

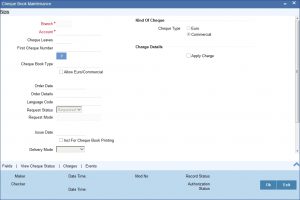

All of this necessitates keeping track of your receivables, which you can easily do with accounting software. It enables you to track, monitor, and take action on overdue/long-pending bills, resulting in an increased cash inflow that is critical for business growth. Many of the household accounting software names, such as QuickBooks, Xero and Zoho Books, can be classified as integrated accounting software solutions.

This reveals a higher level of risk in the customer base and is not always a good sign for the business. Accounts receivable management is the process by which a business oversees and administers the collection of outstanding payments from its customers. Account receivables are outstanding invoices or funds that have not yet been paid by your customers.

That’s true even if they verbally agree to erase the negative item upon full payment of the debt. Accounts receivable and bills receivable will show you which accounts owe you money and which bills are due. Before considering reaching out to Source Receivables Management, we suggest contacting Credit Saint first. From our experience, Source Receivables Management typically does not entertain goodwill letters for removing collection records or charge-offs. They are a legitimate business, however, their persistent calls might feel overwhelming. Any changes to customer data should be properly reported and documented.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business.

Effective account receivable management benefits businesses in a variety of ways. It increases cash inflow by converting sales into cash more quickly. It is also used to expand customer bases through credit sales and to strengthen client relationships with loyal customers by rewarding them. Accounts receivable management that is efficient will benefit the business in a variety of ways. The most important benefit is increased cash inflow due to faster conversion of sales to cash. It also aids in the development of a better relationship with your customer by eliminating discrepancies in pending bills and lowering the risk of bad debts.

Let’s look at an example of how someone settled their debt with SoloSettle. Act fast, as most jurisdictions allow you just two to four weeks to respond. If you don’t file an Answer within this time frame, the court may render a default judgment in favor of Source Receivables accounting 789 flashcards Management. With an educational background in Linguistics, Spanish, and International Development from Brigham Young University, Hannah has also worked as a legal support specialist for several years. If you don’t respond, SourceRM will continue to try and contact you.